Welcome to the Rotary Club of Coeur d’Alene

The Rotary Club of Coeur d’Alene is the largest and most well-known service organization in Coeur d’Alene. For more than 100 years, our members have used their passion, energy, and drive to better Coeur d’Alene, our region, and the world around us.

We are local business, nonprofit, professional, and civic leaders who exemplify “service above self.” We create lasting friendships through our shared Rotary experiences, weekly meetings, service projects, and social events within our community and internationally. We are People of Action. Come join us!

Visit Us!

We invite you to join us! The Coeur d’Alene Rotary Club meets weekly on Fridays at noon at the Coeur d’Alene Resort. Come experience all that Rotary has to offer!

Coeur d’Alene Resort

115 S. Second Street

Coeur d’Alene, Idaho 83814

Become a Member

Intersted in becoming a member? Check out our member handbook for details on joining our Club.

Service Above Self

Rotary is a service organization of business and community leaders united worldwide. As Rotarians, we make a positive impact in our local and global communities.

Current Happenings

Michele Dirks is Rotarian of the Month (April 2024)

Michele Dirks is the April Rotarian of the Month. She has been with this club for about a dozen years and has been described as a champion of giving...

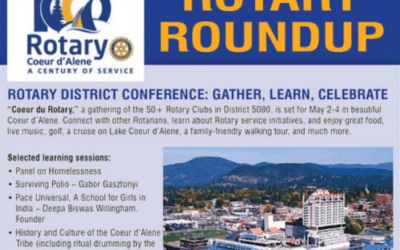

February 2024 Rotary ROUNDUP

A whopping full page of Cd’A Rotary Club published this week, yet this time on the back page of the Coeur d'Alene Press Sunday Business section....

Veterans Pancake Breakfast (April 13)

We'll host our Veterans Pancake Breakfast on April 13 at the VFW Hall (406 N. 4th St. in CDA). Doors open at 9 a.m. with breakfast being served starting at 9:15 a.m. Please RSVP by April 10 to be...

Veterans Pancake Breakfast (April 13)

We'll host our Veterans Pancake Breakfast on April 13 at the VFW Hall (406 N. 4th St. in CDA). Doors open at 9 a.m. with breakfast being served starting at 9:15 a.m. Please RSVP by April 10 to be...

Rotary District 5080 Conference & Celebration (May 2)

On May 2 we’ll host the District Celebration 2024 in beautiful Coeur d’Alene, Idaho and we want you to attend. Why? Because we all could benefit from spending time with fellow Rotarians to network...

Busy meeting this week.

❤️ As tradition holds, Michele Dirks was pleasantly surprised and introduced by Jody Azevedo as our April Rotarian of the Month!

👉 Linda Coppess had the pleasure of welcoming Jeff Ottmar as a new member!

✔️ And filling in for Doug as host, Sandy Patano had the pleasure of running the show and welcoming our guest speaker, Idaho Governor Brad Little.

Topics of interest? Education funding, budget surplus, proactive drug response, homelessness, college and trade schools, diverse skills in a healthy economy, working families and child care. ... See MoreSee Less

0 CommentsComment on Facebook

It was all skis, bikes and sneaks for the Coeur d'Alene Rotary Club team who participated in the 20th Annual Leadman Triathlon at Silver Mountain.

With Greg Helbling skiing, Ryan Johnson cycling and Mike Armon running, they crossed the finish line first in the Rotary Club Division.

Well done, fellas, and all for a good cause. Leadman has raised over $182,000 to provide funding for community projects and non profit organizations with 100% of the proceeds going to local charities. ... See MoreSee Less

7 CommentsComment on Facebook

Yeah baby! The trophy is safe once again. Well done team CdA! 😎

Great job team Rotary !

Congratulations!! Great work!

View more comments

Starting 'em young. In this week's Coeur d'Alene Press — Rotary to the Rescue. Teaching kids about clean water and Rotary involvement. ... See MoreSee Less

1 CommentComment on Facebook

Awesome!